Microfinance And The Feminization Of Poverty In Cambodia

Microfinance lending is a menace to women in Cambodia. A case study published by the Cambodia Microfinance Association[1] (CMA) in January 2024 sheds light on the dangers it creates.

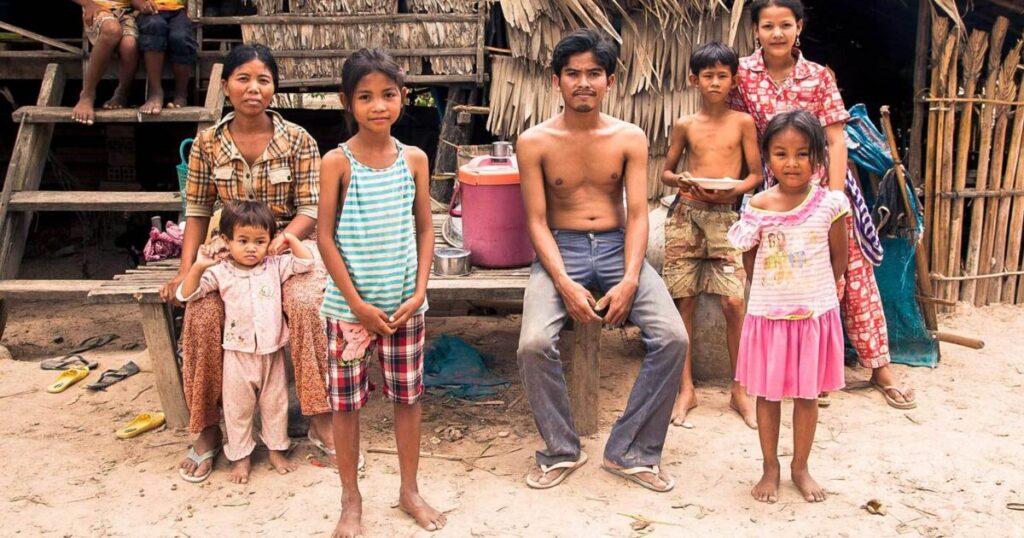

The study, conducted by the Indian ratings agency M-CRIL, focuses on a woman living with her husband and six children in Takeo province. The family’s monthly income is approximately $1,000, and they have been borrowing from microfinance institutions for about 20 years. However, they have gradually fallen into a debt trap and now owe money to seven microfinance lenders, as well as moneylenders, family and friends.

As a result of their indebtedness, some of the family’s older children have dropped out of school to work in a factory, while the younger children collect fruit from the jungle to sell. The family has experienced harassment from microfinance credit officers and has resorted to hiding in the bushes or barrels until the officers leave the area.

The woman is afraid to go home until evening when the officers have left the area. She fears that their small land holdings will be sold to pay off the debt, as the family has little recourse to legal processes, and the village chief has been pressuring them to pay. In Cambodia, land seizures for unpaid debts are often too costly to contest in court, leaving borrowers to negotiate with male village chiefs in an attempt to save their land.

Microfinance lenders have always targeted women because they are considered more reliable repayers than men. This case shows the reality of the cycle of debt that women have to manage, the erosion of educational opportunities for children, and the constant fear of losing property. These factors contribute to the feminization of poverty and the vulnerability of women in Cambodia.The problems caused by microfinance have assumed massive proportions. A report commissioned by the German government and published in 2022 estimated that 167,000 Cambodians had sold land due to over-indebtedness in the previous five years. Lending has continued to accelerate beyond the ability

of the population to repay. As of March 2023, the microloan portfolio rose to more than $16 billion, or nearly half of the country’s GDP.

The International Finance Corporation’s ombudsman in August 2023 launched an investigation into a complaint filed by Cambodian human rights organization LICADHO and Equitable Cambodia into abuses by the country’s major MFIs. LICADHO has made a set of recommendations which can help to reduce microfinance abuses.[1] Microfinance institutions in Cambodia must stop forcing through land sales outside of the judicial system and end predatory lending practices.

LICADHO says there should be debt relief and compensation for borrowers who have suffered microfinance human rights abuses. Microfinance institutions must be prohibited from taking land titles as collateral for new loans, and return all the land titles which are currently being held.